Bitcoin's 452+ Obituaries and Necessary Regulation

Yes, it's that time again. The morning talk shows run the parade of headlines proclaiming Bitcoin is Dead. These are the same networks whose late-night shows would allow celebrities to go on TV and shill their NFTs backed by magical blockchains.

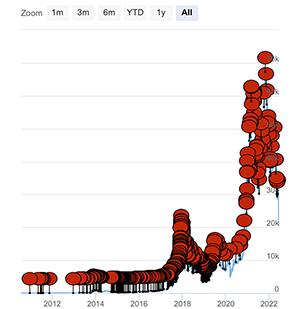

This is nothing new. Take a look at this chart. Each red dot tracks a "Bitoin is Dead" headline across the network's lifetime. That comes to around 452+ obituaries. I'm certain there will be more.

Last month, I wrote about this risk of crypto-companies freezing accounts due to a liquidity crisis in a market downturn. We're seeing this play out now as companies such as Celcius, Babel Finance and potentially Thre Arrows Capital fall into the digital asset version of a bank run (Bloomberg). As always, "not your keys, not your coins."

What's happening now is necessary for Bitcoin. The "crypto-space" needs to burn to the ground for the only truly decentralized ledger system to expedite the decoupling from the trash within the DeFi, NFT, and the meme doggy coin carnival.

The pseudo-decentalized altcoins and companies that offer ridiculous yields on staking cryptocurrencies are acting as magnets that bring bitcoin down.

It's promising to see the SEC eye regulation into the marketplace, as most of the altcoins are potentially operating as unregistered securities. To fit the criteria as a security, these assets may pass what is called the "Howie Test". The following four must be required:

- A party invests money

- In a common enterprise

- With the expectation of profiting

- Based on the efforts of a third party

If an asset fails the Howie test, then it is not a security. Lexology, an online source for legal insights and updates, covers this:

"In 2019, the SEC ruled that Bitcoin, the most popular and highest valued cryptocurrency globally, does not pass the Howey Test.

According to the ruling, Bitcoin checks only the first box of the framework, which states there must be an investment of money. However, because there is no central company controlling Bitcoin, the SEC ruled that it doesn’t meet other points of the Howey Test: Investors are not pooling their funds into a “joint enterprise,” and the value of Bitcoin does not depend on a third party (i.e., developers creating a product).

However, other blockchain-based offerings are unlikely to receive the same treatment from the SEC."

In the short-term, there are no safe sacred cows in this macro-environment. Assets with real value become oversold in this climate. Bitcoin does not operate in a vacuum. There's a war in Europe. US interest rates are spiking. Supply chains continue to break down. China keeps eyeing Taiwan. Foreign central banks are struggling to keep up. I think we're moving into a phase where global financial scenarios that only existed in academic hypotheticals migrate into practical real-world environments.

In other words, things could get weird.

Everything is overfinancialized. And we don't know the true cost of anything. To me - Bitcoin's incorruptible monetary policy, finite supply, and encrypted financial self-custody are absolutely valuable in a world where third party management of monetary policy and wealth custody is being put to the test.

When the dust settles, we'll see if the world begins to understand that.

This article, along with all content and opinions from BTC Examiner, is for educational purposes only and is not financial advice. Please reach out to your financial advisor before making any investment.