The Origins of Bitcoin

Bitcoin didn't just magically appear. It was forged through decades of breakthroughs in computer science that culminated in the creation of the apex digital asset that we know today.

Let's begin this history lesson in the 1970s where the Byzantine General's Problem was formulated. It asks, "How can disparate parties that do not trust each other and may even be antagonistic of each other coordinate to achieve a shared goal, relying on a mutually trusted intermediary?"* In other words, how can two parties across great distances transact value without the need of a third party or trust in each other?

Many entrepreneurs, cypherpunks, and computer scientists spent years solving this problem. In 1989, American computer scientist David Chaum founded DigiCash to keep users' financial transactions private using encryption via its in-house electronic money, eCash. DigiCash went bankrupt and the eCash project shut down in 1998. "It suffered from the problem of centralization: if money is issued by a central authority, then that authority represents a single point of failure."*

The Scarcity Problem

A key characteristic of value is scarcity. How can you establish scarcity without the need for a centralized authority? We became closer to answering that question in 1997 thanks to British cryptographer Adam Back's HashCash system.

Back wasn't intending on solving a money problem, he was trying to solve an email spam problem. To send an email through the HashCash system, the email sender would need to attach something called a unique "hash" to the message to send it. This hash is created by the sender's computer by solving an energy-exhausting computational problem. Thus, to send an email, the user would see a hundredth of a penny increase to their electric bill. That's not painful to a typical user, but very cost-prohibitive to potential email spammers.

Back's initiative failed to materialize in the way he intended, but his hashing technology established a key feature in digital asset value - cryptographic proof that work had been accomplished through the expenditure of energy. Otherwise known as "proof-of-work". This will be important later.

The Distributed Ledger

The march to Bitcoin continued. In 1998, American computer engineer Wei Dai attempted to solve eCash's centralization problem with "b-money" - "a distributed system where participants in the network would each separately maintain a ledger of how much money each participant currently had so that state coercion of any particular participant would be ineffective." Communication between the participants was not infallible, and so the plan never was initialized.

American polymath Nick Szabo continued the journey. In 1998, Szabo proposed another form of digital money called "bit gold". Bit gold took Adam Back's "proof-of-work" hashing mechanism and combined it with a more in-depth distributed ledger system similar to Dai's b-money. Each user would be able to digitally mint a token by using the proof-of-work system (creates "unforgeable costliness" to inflating the token supply), and the distributed ledger would keep track of who owns what. As with previous endeavors, bit gold was never implemented in practice.

A key flaw in the bit gold system was that a hash generated in the past would be less valuable than a hash generated in the future, as computer power increases in strength over time and makes the process of minting new hashes more efficiently than older ones. This decreases the value of bit gold over time and did not make it fungible.

Breakthrough

After an innovation lull in cryptography, the 2008 financial crisis seemed to have spurred a rallying cry to create a decentralized asset that cannot be manipulated by a centralized authority.

On October 31st, 2008, a person or persons calling themselves Satoshi Nakamoto published the bitcoin whitepaper on a popular cryptography mailing list. Readers were skeptical at first, but prominent developers such as Hal Finney began to realize that Nakamoto combined the perfect amount of cryptographic alchemy. It solved eCash's centralization problem, it recalibrated HashCash's proof-of-work system, b-money's distributed ledger, bit gold's token minting method, and assembled the pieces all in a way that Bitcoin could maintain the characteristics of durability, portability, fungibility, verifiability, divisibility, and scarcity.

"None of the component ideas of Bitcoin were new, nor was any of the cryptography novel, but Nakamoto had arranged the system in a perfect balance of economic incentives and cryptographic guarantees."*

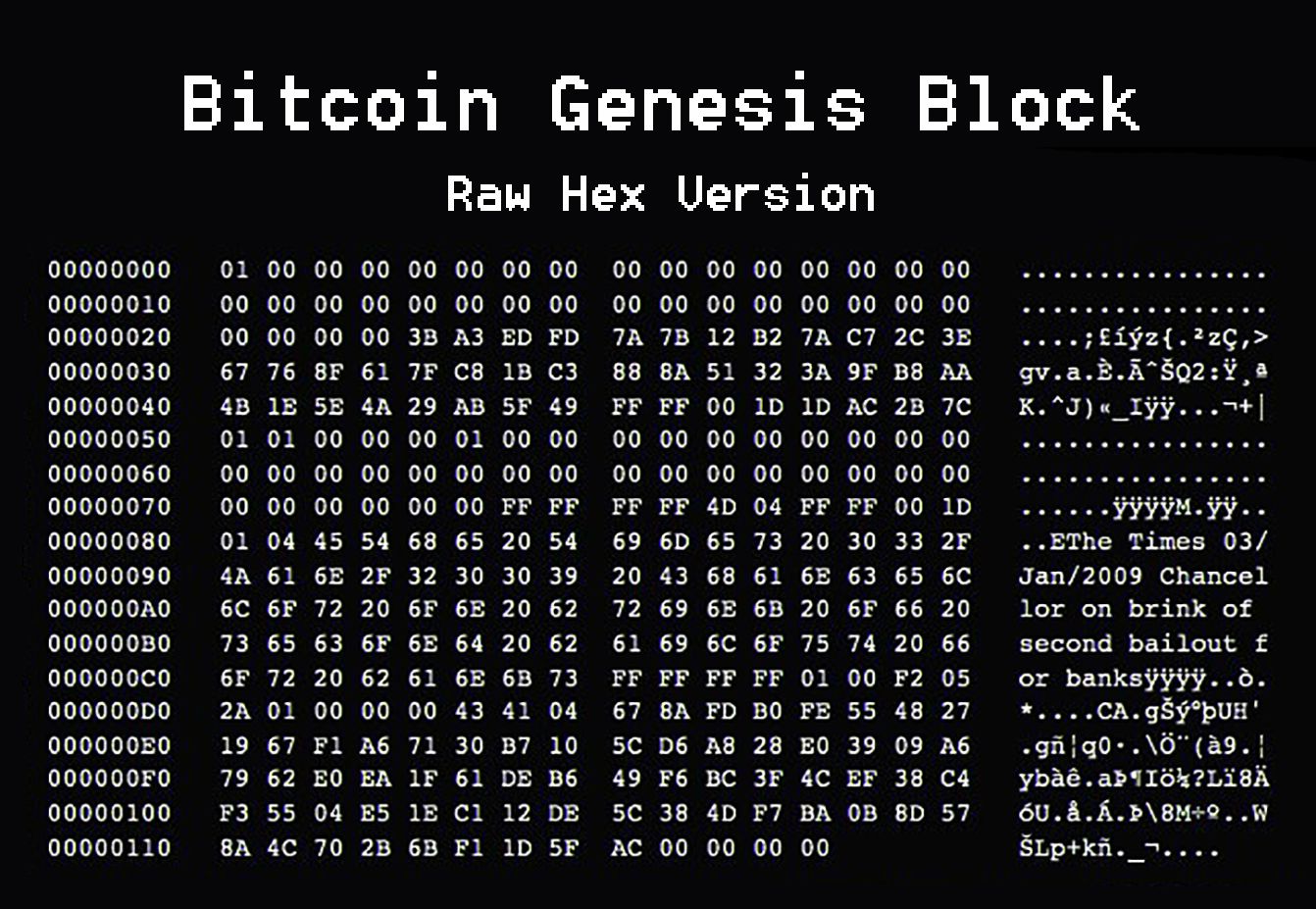

All it needed next was established history. On January 3rd, 2009, the bitcoin network launched. On May 22nd, 2010, the first bitcoin transaction occurred between two individuals negotiating on a bitcoin forum. The deal? Two Papa John's pizzas for 10,000 BTC.

Since then, Bitcoin has grown to over a trillion-dollar market cap. Not by luck, but by its cryptographic characteristics that took decades to engineer.

*"The Bullish Case for Bitcoin" by Vijay Boyapati

This article, along with all content and opinions from BTC Examiner, is for educational purposes only and is not financial advice. Please reach out to your independent financial advisor before making any investment.