Fidelity: Bitcoin is a "Superior Form of Money"

Earlier this week, Fidelity Digital Assets published an in-depth report on Bitcoin's characteristics, capabilities, and growing status as a monetary good.

The key takeaway here is that Fidelity agrees with the growing sentiment in this current Bitcoin growth cycle: that Bitcoin is a digital asset that should be considered in a class of its own and should not be compared to other cryptocurrencies.

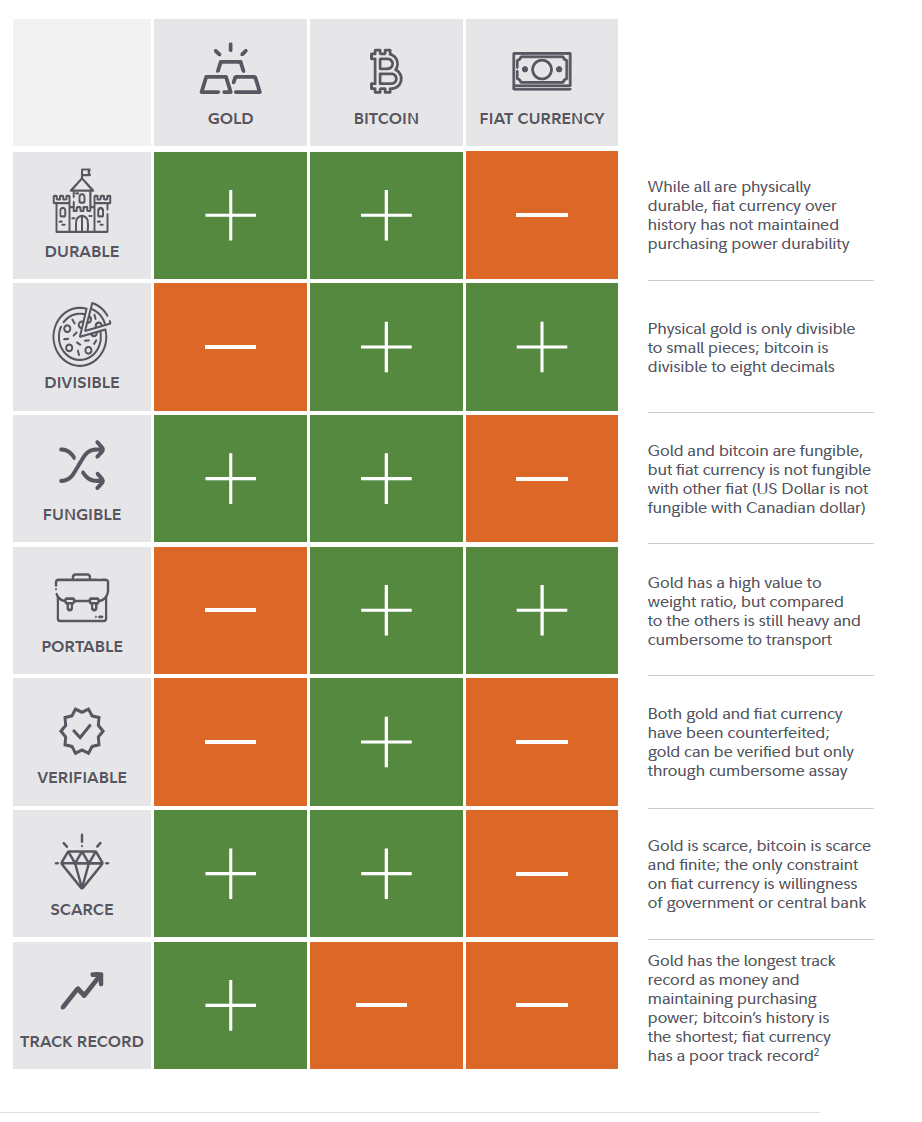

Bitcoin is unique in its decentralized nature, unparalleled security, and immutable monetary policy. It's implausible that another digital asset can replace bitcoin. If one were to copy Bitcoin's programming code and promote a "Bitcoin 2", this new network would lack the mining/node security apparatus compared to the original Bitcoin with a 13-year head start. Thus, Bitcoin's network effect greatly diminishes the incentive of a Bitcoin copycat from taking hold. Also, if a Bitcoin competitor tried to "improve" upon bitcoin as a monetary good, it would have to face serious tradeoffs (improved transaction speeds at the cost of security) - once again leaving Bitcoin in a category all on its own.

And on top of that, companies and open-source projects are already hard at work on building layer-2 applications such as the Lightning Network (faster bitcoin payments) and Web 3.0 applications such as trustmachines.co, that are built on top of Bitcoin and use its decentralized security network as the final settlement layer. In other words, Bitcoin is just getting started and isn't going anywhere.

Fidelity explains:

Traditional investors typically apply a technology investing framework to bitcoin, leading to the conclusion bitcoin as a first-mover technology will easily be supplanted by a superior one or have lower returns. However, as we have argued here, bitcoin’s first technological breakthrough was not as a superior payment technology but as a superior form of money. As a monetary good, bitcoin is unique. Therefore, not only do we believe investors should consider bitcoin first in order to understand digital assets, but that bitcoin should be considered first and separate from all other digital assets that have come after it.

You can find the full Bitcoin report from Fidelity here.

This article, along with all content and opinions from BTC Examiner, is for educational purposes only and is not financial advice. Please reach out to your financial advisor before making any investment.